Browse posts by category

How to create a small business budget | Run your business

How to create a small business budget | Run your business Learn more about creating a small business budget: (For US-based businesses) https://intuit.me/3jI9yQj...

Continue reading

How to prepare for tax season with QuickBooks Pro Advisor & QuickBooks Live Bookkeeper

How to prepare for tax season with QuickBooks Pro Advisor & QuickBooks Live Bookkeeper Suzanne Norman, QuickBooks Pro Advisor and QuickBooks Live...

Continue reading

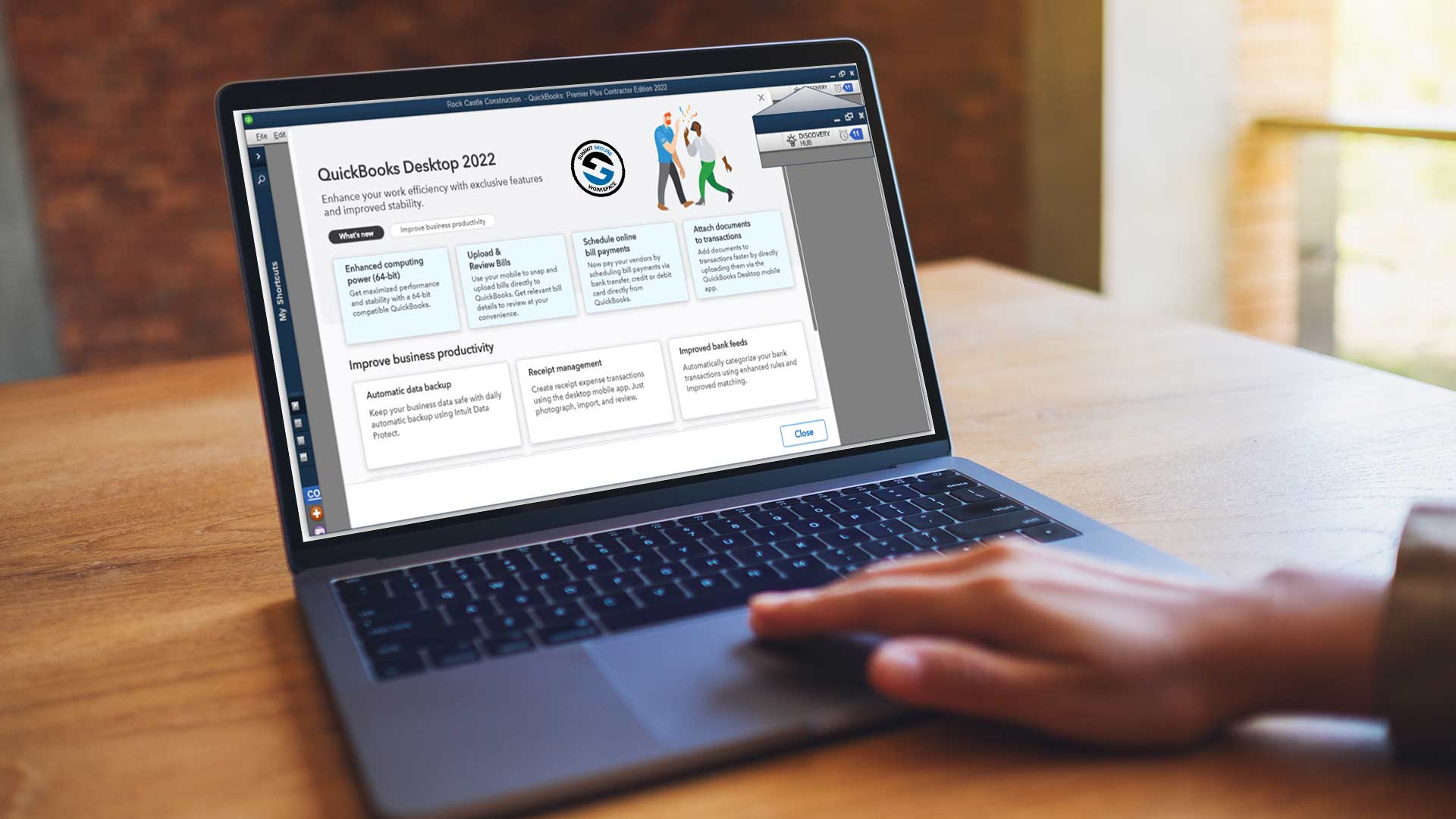

QuickBooks 2022: What’s New and What You Need to Know

As of September 28, 2021, QuickBooks 2022 has officially been released. This continues the annual trend of Intuit releasing a new version of QuickBooks...

Continue reading

How to: Your guide to W-2s for 2021 taxes | QuickBooks Desktop

How to: Your guide to W-2s for 2021 taxes | QuickBooks Desktop This video will go over how to make sure processing...

Continue reading

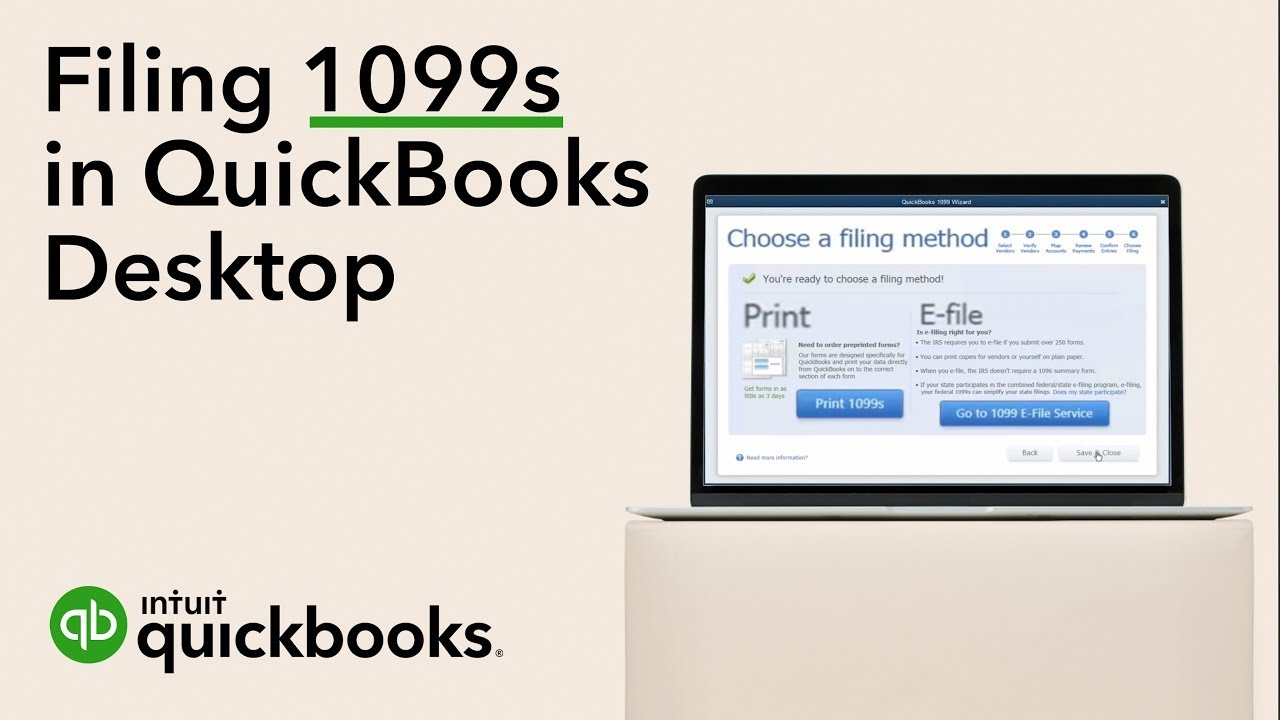

How to: Your guide to 1099s for 2021 taxes | QuickBooks Desktop

How to: Your guide to 1099s for 2021 taxes | QuickBooks Desktop We will go over how to set up 1099s in your...

Continue reading

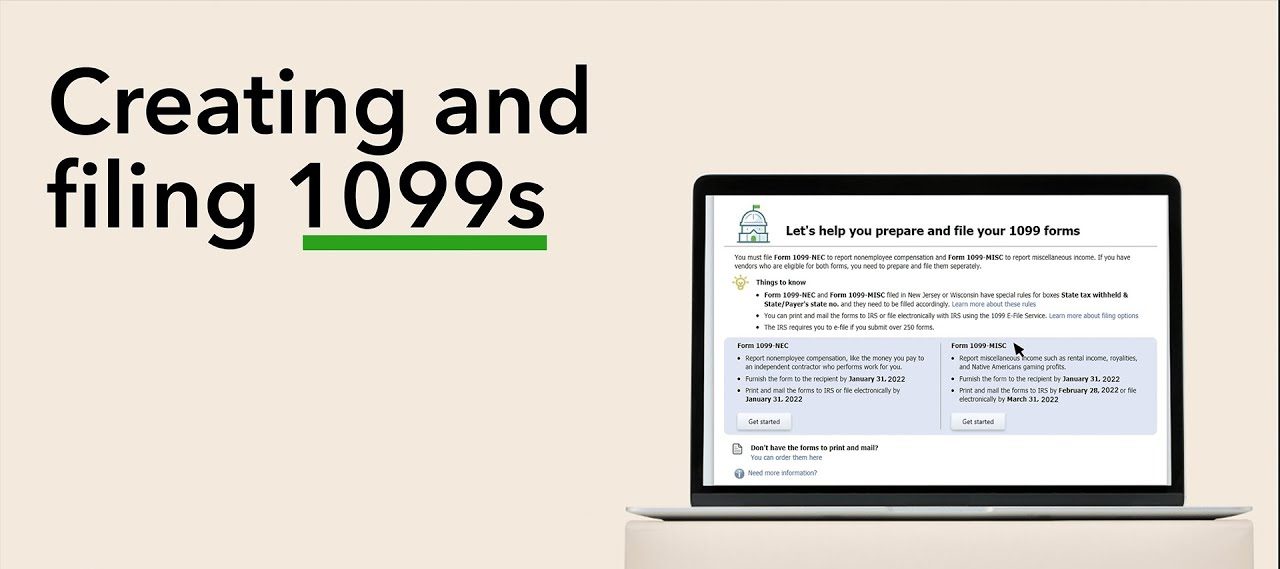

How to create and file 1099s in QuickBooks Desktop

How to create and file 1099s in QuickBooks Desktop https://www.youtube.com/watch?v=PxczRPFS9kA Some important notes they highlight regarding 1099s: QuickBooks Desktop supports both the 1099-NEC100 and...

Continue reading

What are accounts receivable? | Morgan Law @FinePoints

What are accounts receivable? | Morgan Law @FinePoints Learn more about accounts receivable: https://intuit.me/38GrYL6 How to follow up on past-due invoices: https://youtu.be/yzwmV1i1NNI What...

Continue reading

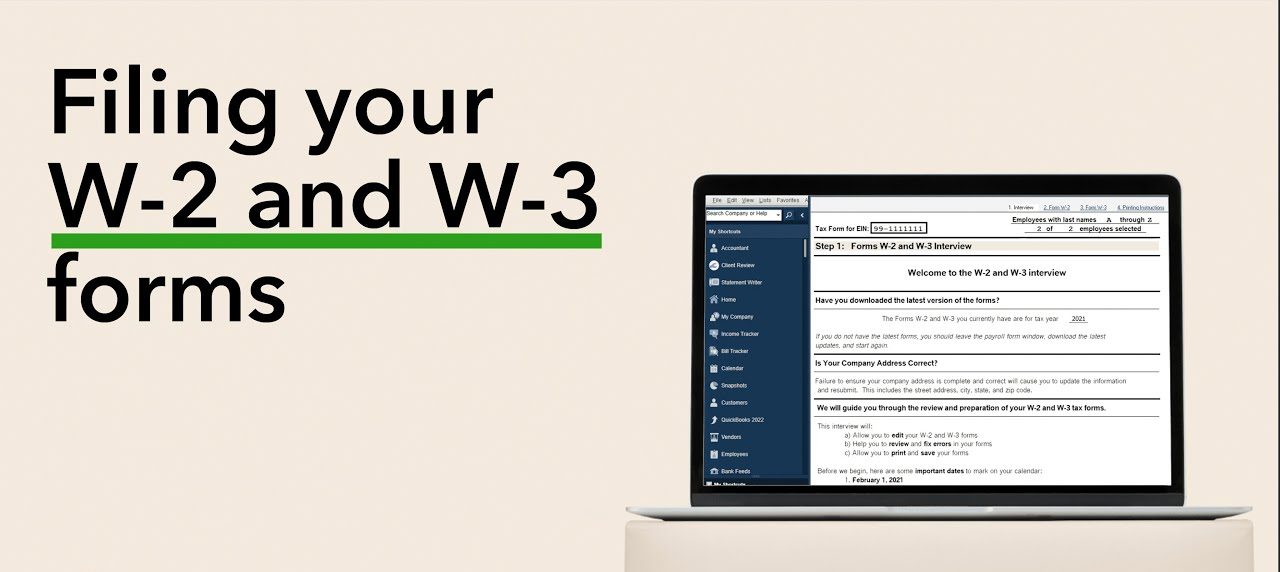

How to file your W-2 and W-3 forms in QuickBooks Desktop Payroll Enhanced

How to file your W-2 and W-3 forms in QuickBooks Desktop Payroll Enhanced How to file your W-2 and W-3 forms with the...

Continue reading

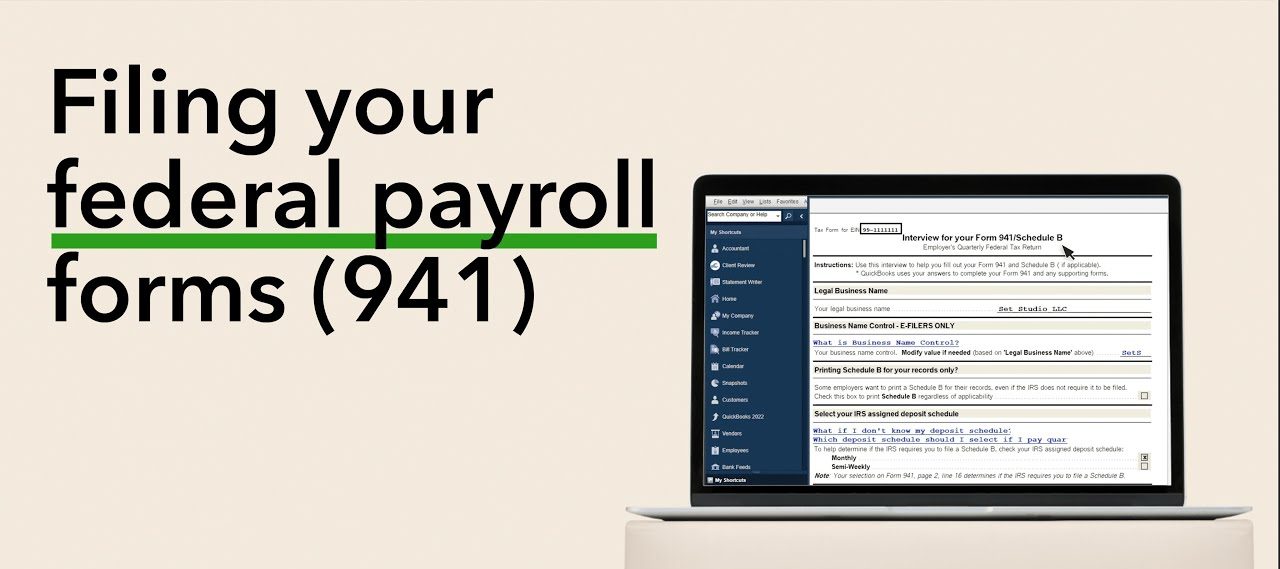

How to file your federal payroll forms (941) with QuickBooks Desktop Payroll Enhanced

How to file your federal payroll forms (941) with QuickBooks Desktop Payroll Enhanced At the end of each calendar quarter and year you’ll...

Continue readingBrowse more posts...